Manage your monthly expenses and never miss a subscription payment again. Our comprehensive guide makes it easy to stay on top of your recurring payments on your Credit One Bank card. By understanding your credit card account balance, you'll be able to set up automatic payments and efficiently manage your existing credit card account.

We'll show you how to quickly and efficiently locate and view all of your subscriptions, providing a better payment method for complete control and peace of mind.

Whether using Credit One's website, app, or ScribeUp, you'll be able to easily discover and cancel any unwanted subscriptions with just a few clicks, ensuring you never exceed your credit line. Say goodbye to surprise charges and take control of your finances today with our simple and straightforward guide.

Credit One Bank where you can get the Credit One Bank Platinum, Credit One Bank American Express, Credit One Bank Wander Cards

Credit One Bank where you can get the Credit One Bank Platinum, Credit One Bank American Express, Credit One Bank Wander CardsCredit One Bank offers various cards including the Credit One Bank Platinum, Credit One Bank American Express, Credit One Bank Wander Cards, each offering different benefits like cash advance and statement credit options.

10-steps via the Credit One Bank App

- Login to your Credit One Bank App

- Tap the Credit Card (or another Credit One Bank Account) that you want to find your recurring payments

- Scroll down to the bottom and tap Documents & Statements

- Tap on the most recent year and month to find monthly statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and the due date for the next payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Credit One card (e.g., Credit One Bank Platinum, Credit One Bank American Express, Credit One Bank Wander) you have in your wallet.

- Review your account regularly and manage card controls as needed.

10-steps via creditonebank.com

- Login tom your online banking account via https://www.creditonebank.com/ (click Login on the right hand side)

- Click Documents & Statements in the menu at the top

- Select the Credit Card (or another Credit One Bank Account) that you want to find your recurring payments

- Click the most recent statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Credit One card (e.g., Credit One Bank Platinum, Credit One Bank American Express, Credit One Bank Wander) you have in your wallet.

- Review your account regularly

For Credit One Card holders, it's advantageous to adopt a more frequent review of your card statements, rather than limiting it to an annual check. We advise conducting these reviews at least twice within a year, and at different points in time, when using your Credit One Cards. The rationale behind this is straightforward: we often sign up for new, low-cost subscriptions as part of our routine, and these charges can blend into our Credit One Card statements, remaining unnoticed. These small, recurring costs can accumulate, subtly impacting your financial planning. By reviewing your statements at various times of the year, you can effectively track and manage these subscriptions, ensuring you're not inadvertently accruing costs from services that are no longer essential to you.

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

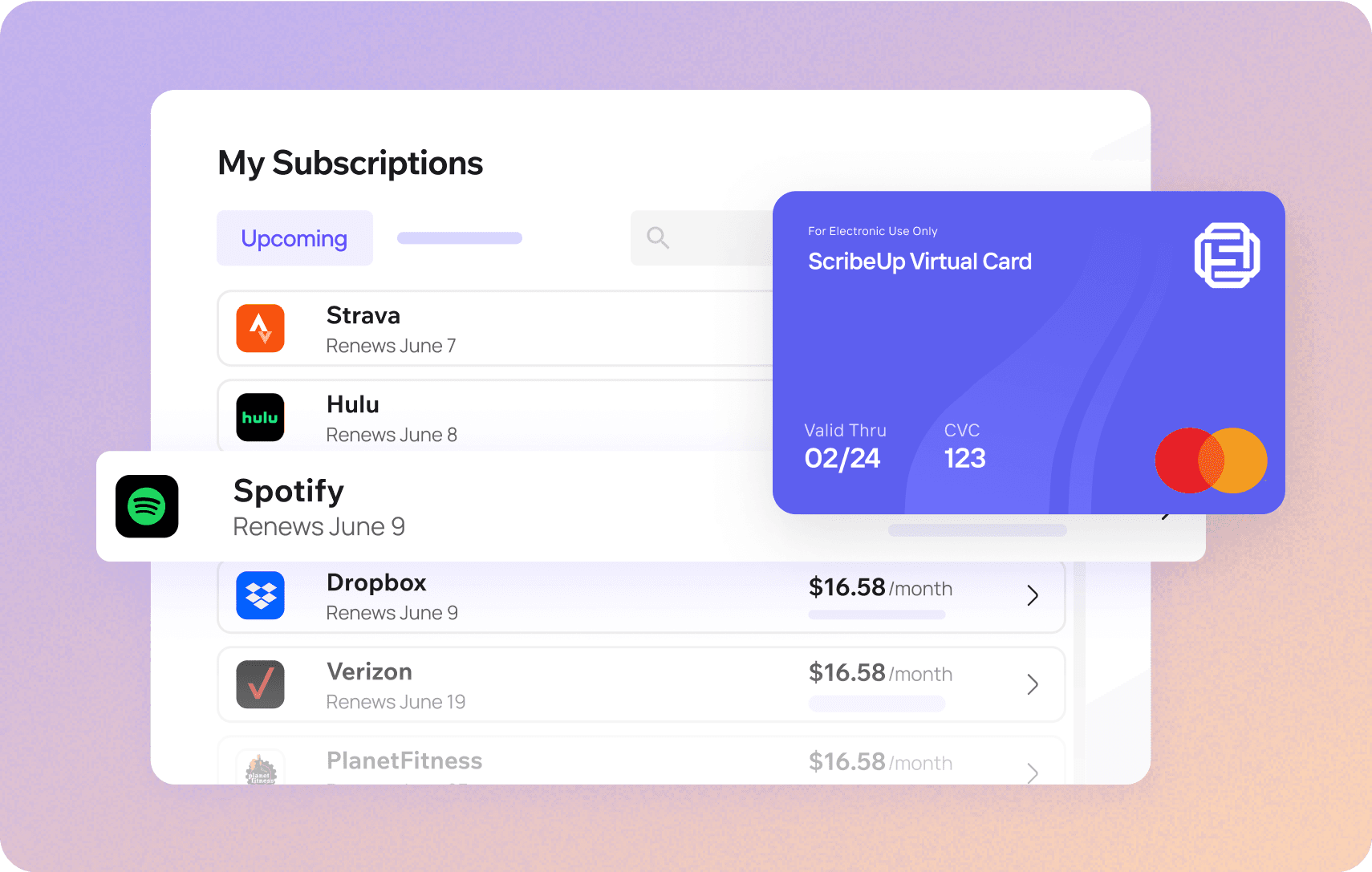

With ScribeUp, managing subscriptions on your Credit One Bank Cards becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Credit One Bank Cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Credit One Bank Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.