Struggling with excessive charges from subscriptions you no longer utilize? Or simply looking to monitor your monthly expenses more closely? Look no further.

Discovering and managing your subscriptions can be a breeze. In this guide, you will learn how to quickly and easily find and view your recurring payments and subscriptions on your PNC card. We show you how to find and cancel your subscriptions via PNC's website, app, and via !

PNC Bank where you can get different cards including PNC Cash Rewards, PNC Core, PNC Points, PNC Premier Traveler

PNC Bank where you can get different cards including PNC Cash Rewards, PNC Core, PNC Points, PNC Premier TravelerManage Your PNC Card: Guide to Find & Cancel Recurring Payments

10-steps via the PNC Bank App

- Login to your PNC Bank App.

- Tap the Virtual Wallet spending account (or another PNC Card Account) that you want to check your recurring payments.

- Scroll down to the bottom and tap Account Actions.

- Tap Online Statements and click on the most recent year and month to check the monthly statement.

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click the previous month's statement to ensure the monthly or yearly subscription charge is the same and wasn't increased.

- If the charge is there and it is wrong, you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single PNC card (e.g., PNC Cash Rewards, PNC Core, PNC Points, PNC Premier Traveler) you have in your wallet.

- Review your account regularly.

It's vital to regularly check bank statements for unnoticed recurring charges. Subscriptions, typically less than $15, can easily be overlooked due to their small size, but when accumulated, they represent a significant expense. In 2020, CNBC stated that the average individual often subscribes to around 12 different services, from digital entertainment to various online tools. These seemingly minor charges can cumulatively lead to a considerable monthly expenditure, making it important to stay vigilant and regularly audit these subscriptions to manage one's financial health effectively.

11-steps via pnc.com

- Log in via https://www.pnc.com/en/personal-banking.html (click Login on the top right corner)

- In Account Summary, click the Credit Card or Checking/Savings Account you want to review

- Click Online Statements

- Click Current Statement

- Click View

- Review statements line-by-line to find unwanted recurring payments

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment

- Click the previous month's statement to ensure the monthly or yearly subscription charge is the same and wasn't increased

- If the charge is there and it is wrong, you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually

- Repeat steps 1-9 for every single PNC card (e.g., PNC Cash Rewards, PNC Core, PNC Points, PNC Premier Traveler) you have in your wallet

- Review your account regularly

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

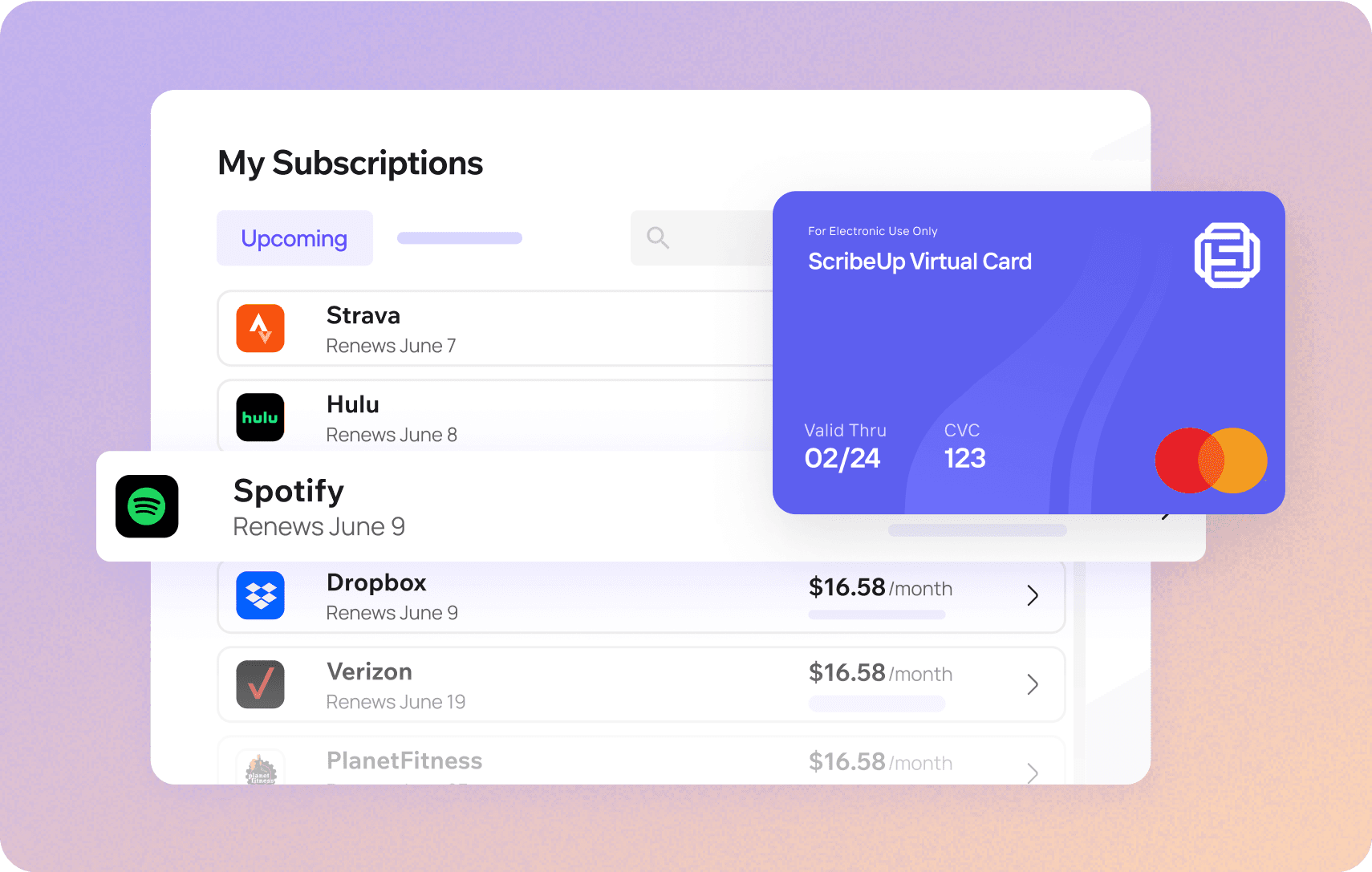

With ScribeUp, managing subscriptions on your PNC Bank card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your PNC Bank cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your PNC Bank Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.