Back in 2017, Wells Fargo created Control Tower, which helped customers manage their recurring payments through the app. Upon calling Wells Fargo’s customer service team, ScribeUp found that this feature on the mobile app doesn’t exist anymore. In addition, Well Fargo’s FAQ unhelpfully advises you to “contact the merchant or service provider directly to request changes or cancellations to recurring automatic debit payments.” Instead a user will have to manually find their recurring subscription charges. We created a guide to help you find and cancel recurring payments on any of your Wells Fargo cards.

How to find and cancel automatic payments on your Wells Fargo cards

How to find and cancel automatic payments on your Wells Fargo cardsAll the ways to find subscriptions on your Wells Fargo cards

9 steps via the Wells Fargo App

- Login to your Wells Fargo App

- Tap the account or credit card (e.g., Wells Fargo Cash Wise Visa Card, Wells Fargo Propel American Express Card, Wells Fargo Platinum Visa Card, Wells Fargo Rewards Card, Wells Fargo Secured Credit Card) that you want to find your recurring payments

- In Statements, tap the most recent month’s statement

- Review statements line-by-line to find the unwanted automatic payment.

- Take note of the merchant name, amount, and next scheduled payment date for each automatic billing.

- Click the previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-7 for every single Wells Fargo card (e.g., Wells Fargo Cash Wise Visa Card, Wells Fargo Propel American Express Card, Wells Fargo Platinum Visa Card, Wells Fargo Rewards Card, Wells Fargo Secured Credit Card) you have in your wallet.

- Review your account regularly

It's essential in our subscription-dominated landscape to keep a close eye on bank statements for hidden recurring fees. Many subscriptions, often modestly priced below $15, can go unnoticed amidst our financial transactions. Yet, these small amounts can collectively become a significant financial burden. With the average person juggling around 12 subscriptions, from streaming platforms to online services, these overlooked charges can quietly accumulate. Regularly reviewing bank statements to identify and manage these subscriptions is a key step in maintaining financial awareness and preventing unnecessary spending.

10 steps to stop future payments via wellsfargo.com

- Login via https://connect.secure.wellsfargo.com/auth/login/present

- In Account Summary, click the Credit Card or Checking/Savings Account you want to review

- Click View Statements

- Click the most recent month’s statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Wells Fargo card (e.g., Wells Fargo Cash Wise Visa Card, Wells Fargo Propel American Express Card, Wells Fargo Platinum Visa Card, Wells Fargo Rewards Card, Wells Fargo Secured Credit Card) you have in your wallet.

- Review your account regularly

Let’s be real, this is not ideal. To start, many subscription services won’t be called what you think they are on the statement. For example, the local gym that you might get charged for might be under the parent company name — making it difficult to decipher. Another pain point is that not all subscriptions are created equally meaning that they all have different auto-renewal periods: some are monthly, others are semi-annually, some are yearly! This makes it really hard to identify subscriptions on your Wells Fargo Card manually.

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions on Your Wells Fargo Card

With ScribeUp, managing subscriptions on your Wells Fargo card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

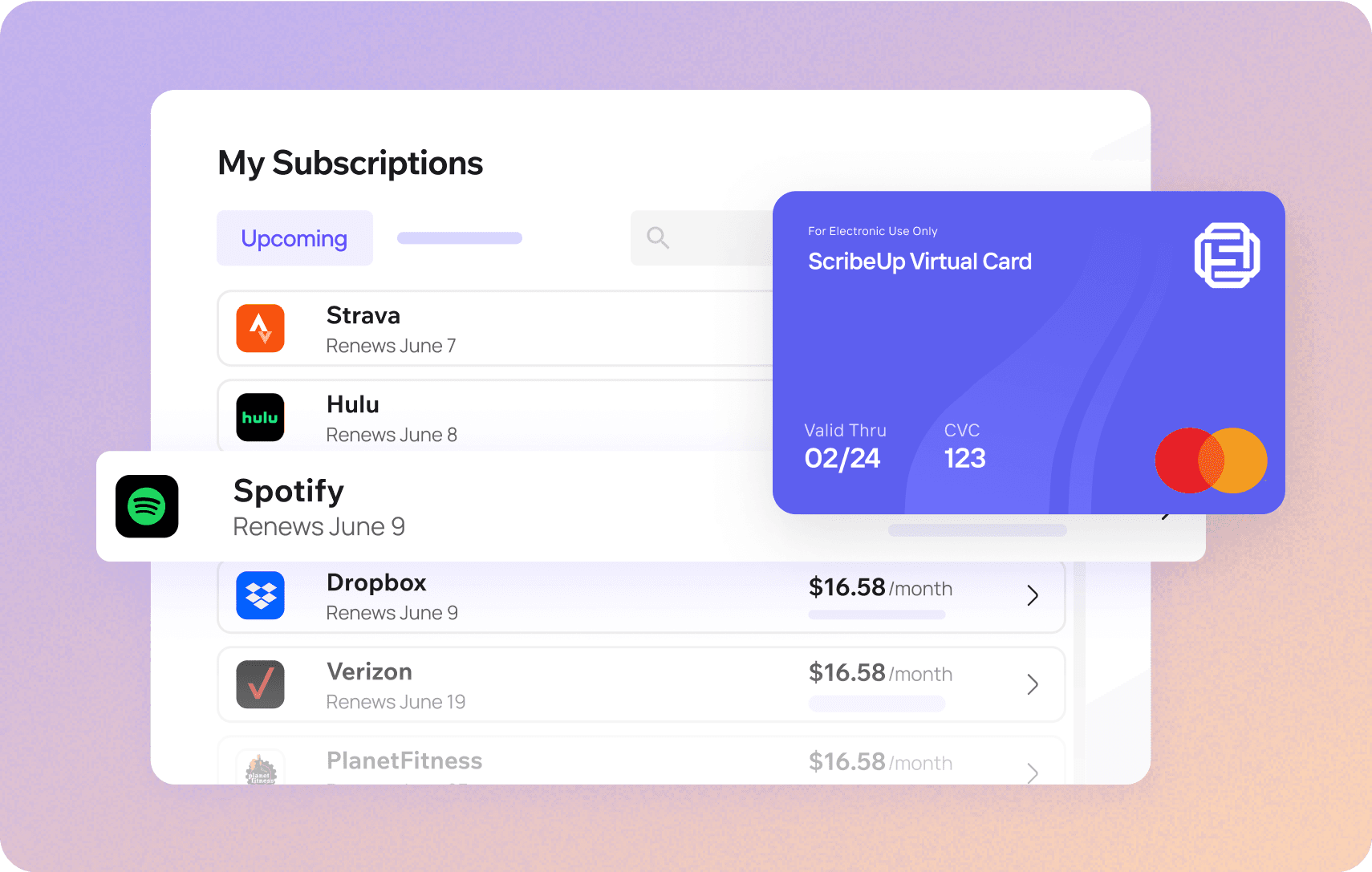

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Wells Fargo Bank cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Wells Fargo Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.