Do you often find yourself struggling to keep track of your monthly subscriptions and get surprised by unexpected charges on your Navy Federal Credit Union card? If so, you're not alone. But there is a way out.

Our guide is designed to help you streamline your money management, take control of your automatic payments, and truly leverage the power of your savings account.

In this comprehensive guide, we will show you how to easily manage your monthly budget and track all recurring payments on your Navy Federal Credit Union card. We will walk you through how to find and view all subscriptions, either using the Navy Federal Credit Union's website, its mobile app, or ScribeUp. We will also show you how to cancel any unwanted ones with just a few clicks. Say goodbye to surprise charges, and hello to complete control of your finances.

Finding Subscriptions on your Navy Federal Credit Union cards

Finding Subscriptions on your Navy Federal Credit Union cardsJoin the ranks of savvy spenders who have unlocked financial freedom by effectively managing their existing accounts, ensuring they make at least the minimum payments on time, and cancelling any unwanted subscriptions. With this guide, you'll not only be able to prevent surprise charges but also safeguard yourself against potential identity theft. Say goodbye to the stress of missed payments and welcome peace of mind knowing that you have full control over your financial destiny.

Manage Navy Federal Cards: Find & Cancel Unwanted Subscriptions

11-steps to find and cancel subscriptions via the mobile app

- Login to your Navy Federal Credit Union Mobile App

- At the bottom of the Accounts screen (should be the default screen), tap More (three dots on the right corner)

- Tap Account & Tax Statements

- Tap Account Statements

- Tap on the most recent year and month to find monthly statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-9 for every single Navy Federal Credit Union card (e.g., Navy Federal cashRewards, Navy Federal Platinum, Navy Federal GO REWARDS, Navy Federal Visa Signature Flagship Rewards) you have in your wallet.

- Review your account regularly

I want to stress Step 11. Diligently reviewing bank statements is key. Small, recurring charges, usually under $15, can easily escape hawk-eyes compared to other bigger expenses. However, they can add up to a substantial sum. On average, users pay $381 in monthly subscriptions. These overlooked subscriptions, though individually minor, can collectively lead to significant monthly outlays. Therefore, consistently monitoring these charges in bank statements is crucial for effective financial management and avoiding unnoticed expenditure.

10-steps to find and cancel subscriptions via the Navy Federal website

- Login via https://www.navyfederal.org/

- Click Statements

- In Statements Overview, select the Credit Card (or another Navy Federal Bank Account) that you want to find your recurring payments

- Filter for the month or year that you want to review or click the most recent statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Navy Federal Credit Union card (e.g., Navy Federal cashRewards, Navy Federal Platinum, Navy Federal GO REWARDS, Navy Federal Visa Signature Flagship Rewards) you have in your wallet.

- Review your account regularly

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

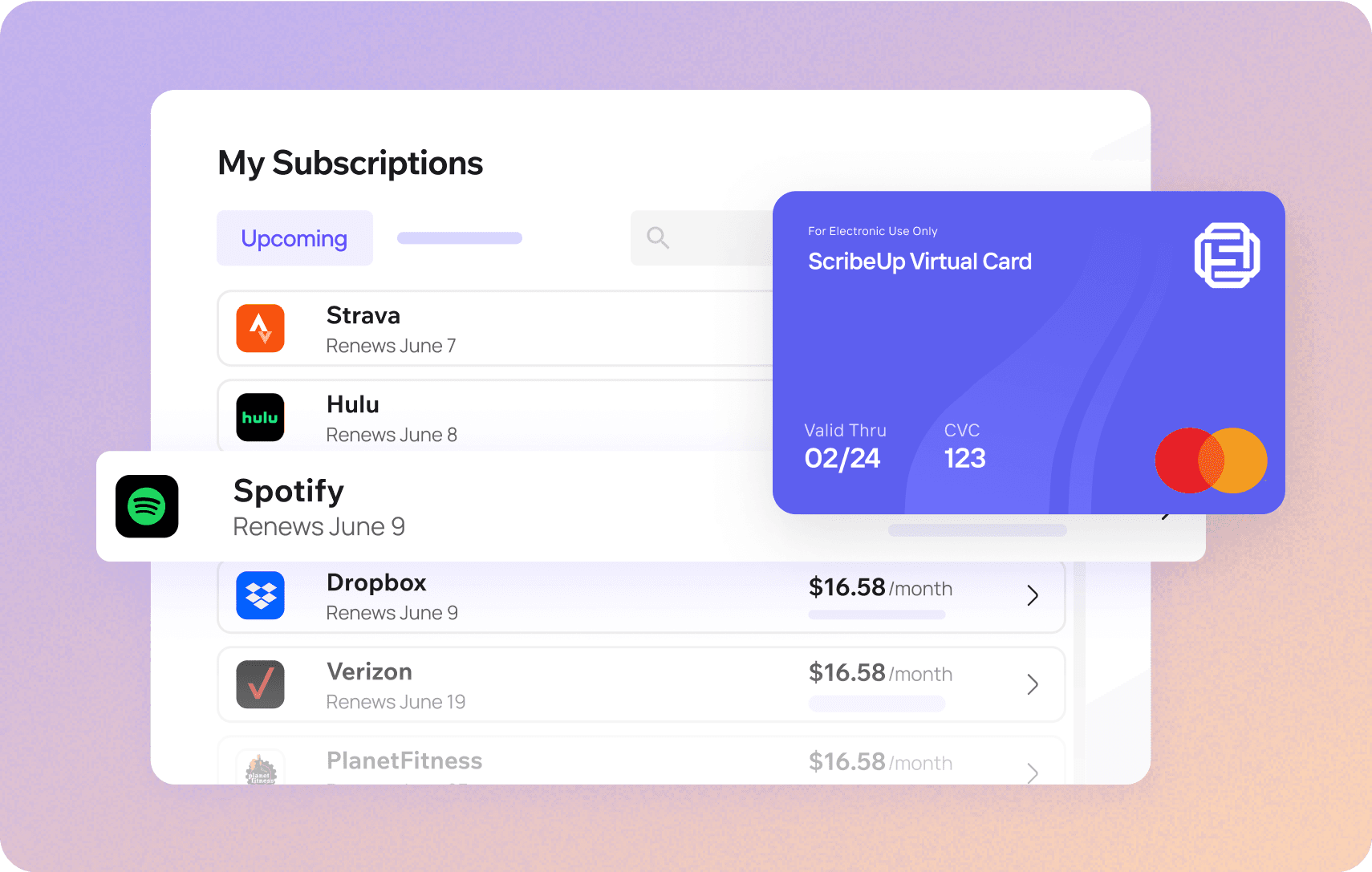

With ScribeUp, managing subscriptions on your Navy Federal Credit Union card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Navy Federal Credit Union cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Navy Federal Credit Union Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.