Are you constantly surprised by unexpected charges stemming from forgotten subscriptions? If so, it's time to streamline your monthly budget and gain financial freedom by canceling those pesky subscriptions. This can be easily done via Fifth Third Bank's website or app. Whether you're accustomed to online banking or still warming up to it, this guide provides step-by-step instructions to locate and halt these subscriptions.

Unwanted subscriptions don't only affect credit card users. They can also creep into your checking accounts, draining your funds with every debit card transaction. Even if you meticulously monitor your accounts, these charges can get lost in the shuffle, like a lost or stolen card, potentially upsetting your financial balance.

Through this article, you will be able to take back control of your finances, ensuring every direct deposit into your savings account counts. By cutting off unwanted recurring charges, your hard-earned money can be dedicated to the purchases you desire rather than slipping away into the abyss of forgotten subscriptions. So, let's bid farewell to these unwanted debit card purchases and embrace the newfound control over your debit card transactions, steering you towards a path of financial freedom.

Finding subscriptions on your Fifth Third Bank Cards

Finding subscriptions on your Fifth Third Bank Cards10-steps to cancel subscriptions via the Fifth Third Bank App

- Login to your Fifth Third Bank App

- In the home screen, tap Statements

- Filter for the credit card (or another Fifth Third Account) that you want to find your recurring payments

- Tap on the most recent year and month to find monthly statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Fifth Third Bank card (e.g., Fifth Third Bank Platinum Capital One Mastercard, Fifth Third Bank Premier World Mastercard, Fifth Third Bank World Mastercard, Fifth Third Bank Secured Mastercard, Fifth Third Bank Cash Rewards Mastercard) you have in your wallet.

- Review your account regularly

10-steps to cancel subscriptions via the Fifth Third Bank website

- Login via https://www.53.com/content/fifth-third/en.html

- Click Documents

- Filter for the credit card (or another Fifth Third Account) that you want to find your recurring payments

- Click the most recent statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Fifth Third Bank card (e.g., Fifth Third Bank Platinum Capital One Mastercard, Fifth Third Bank Premier World Mastercard, Fifth Third Bank World Mastercard, Fifth Third Bank Secured Mastercard, Fifth Third Bank Cash Rewards Mastercard) you have in your wallet.

- Review your account regularly

For those using Fifth Third Bank Cards, it's beneficial to look over your card statements more than just once annually. We recommend reviewing your Fifth Third Bank Card statements at least biannually, with these checks spaced out through the year. This approach is essential because new subscriptions, often with modest costs, tend to be added regularly to our daily activities. These seemingly small charges on your Fifth Third Bank Card can easily go unnoticed, gradually adding up and impacting your budget. Regular, spaced-out statement reviews help in identifying these recurring expenses, ensuring you're not paying for subscriptions that you no longer need or use.

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

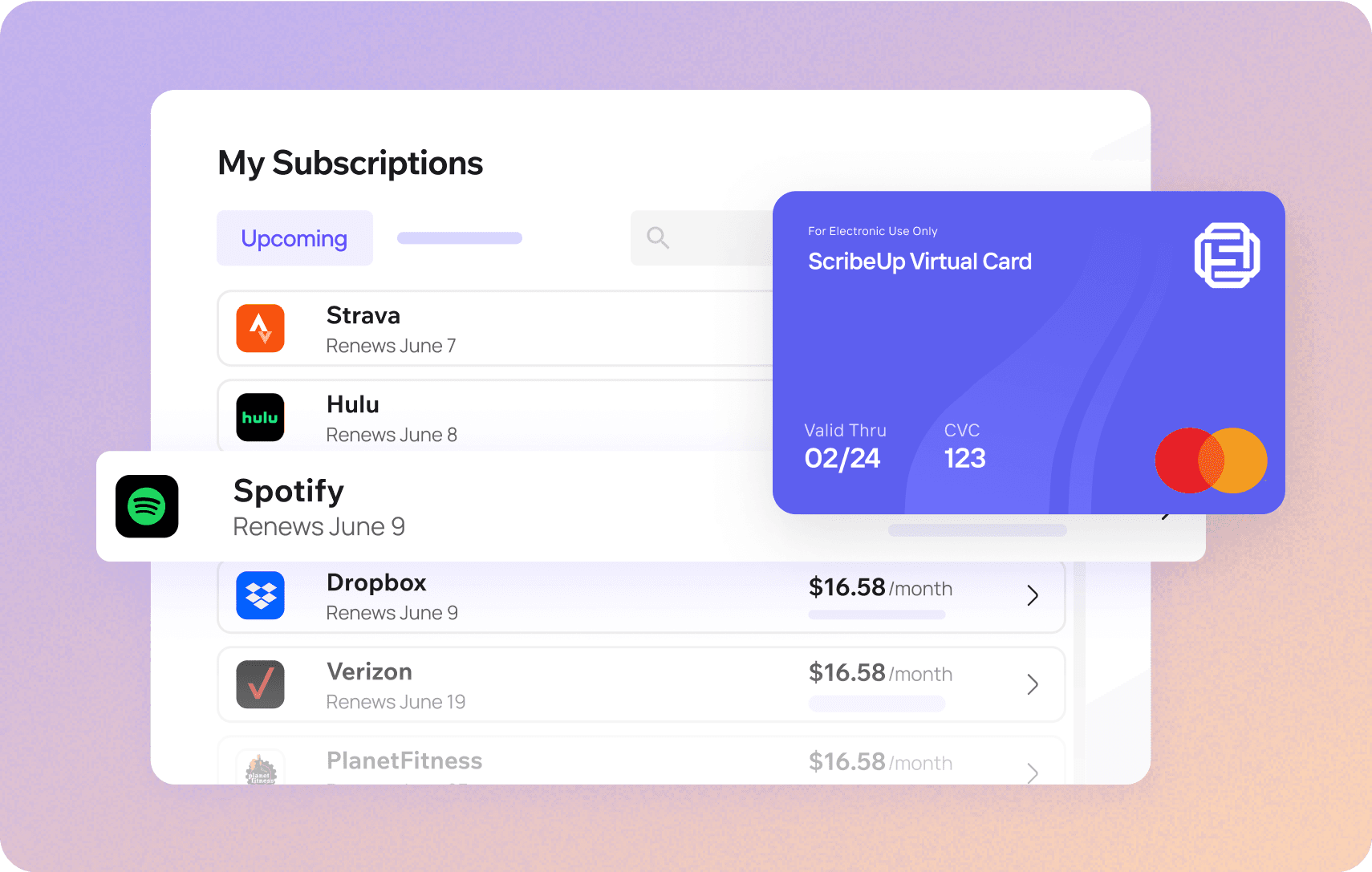

With ScribeUp, managing subscriptions on your Fifth Third Bank Card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Fifth Third Bank Cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Fifth Third Bank Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.