Discovering and eliminating undesired subscriptions on your TD Bank card just got simpler. Subscriptions have infiltrated our everyday life and expenses. From digital services like Netflix and Spotify to physical product deliveries such as meal kits and beauty boxes, the business model has exploded over the last decade. However, it's all too easy to lose track of our monthly spending amid this flurry of automatic renewals.

While TD Bank's website and mobile app offer robust banking solutions, they aren't designed specifically to track and manage subscriptions. Nevertheless, they can be instrumental in uncovering hidden costs eating into your budget. By diligently examining your transaction history and identifying any automatic payments, you can unveil these silent budget-drainers.

And once detected, it's a matter of reaching out to the respective service providers to cancel the subscriptions. This article will serve as your guide to regain control over your financial health, helping you navigate through the process of detecting and canceling unwanted subscriptions on your TD Bank card.

By leveraging the tools at your disposal, you can say goodbye to surprise charges and hello to a well-managed, streamlined monthly budget.

11-steps to find and cancel recurring payments via TD Bank’s mobile app

- Login to your TD Bank App

- In the home screen, Tap My Accounts

- Select the Credit Card (or another TD Bank Account) that you want to find your recurring payments

- Tap Statements & Documents

- Tap on the most recent year and month to find monthly statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually

- Repeat steps 1-9 for every single TD Bank card (e.g., TD Cash Secured Credit Card, TD Business Solutions Credit Card, TD First ClassSM Visa Signature Credit Card, TD Cash Credit Card) you have in your wallet

- Review your account regularly

Reviewing credit card statements more than once a year is a financial best practice we strongly recommend. Ideally, conducting this review twice a year, at intervals spaced well apart, is beneficial. The reason? Subscriptions are frequently added to our daily routines, and due to their relatively low costs, they often blend into the background of our statements, going unnoticed. These "negligible" charges can accumulate over time, impacting your budget more than you might realize. Regular reviews, spaced months apart, help catch any new subscriptions and assess whether they are still valuable or have become unnecessary expenses.

11-steps to find and cancel recurring payments via TD Bank’s website

- Login via https://onlinebanking.tdbank.com/

- Click Accounts

- Click Statements & Documents

- Filter Get statements by account and select the credit card (or another TD Bank Account) that you want to find your recurring payments

- Click the most recent statement under Your most recent notifications

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually

- Repeat steps 1-9 for every single TD Bank card (e.g., TD Cash Secured Credit Card, TD Business Solutions Credit Card, TD First ClassSM Visa Signature Credit Card, TD Cash Credit Card) you have in your wallet

- Review your account regularly

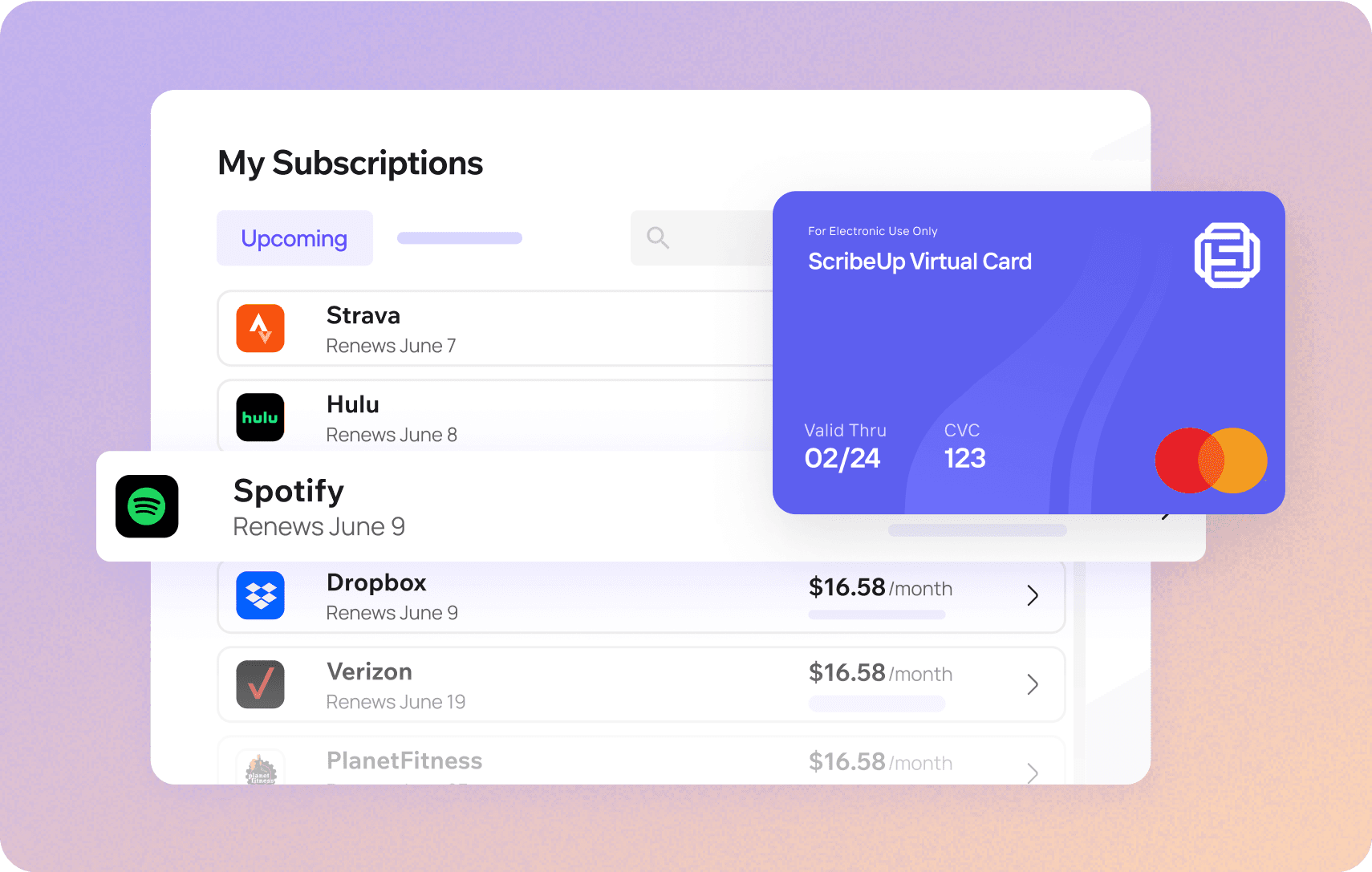

3-steps via : The Easiest Solution for Identifying & Canceling Subscriptions

With ScribeUp, managing subscriptions on your TD Bank card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your TD Bank cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your TD Bank Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.