Are you weary of the constant vigilance required to scrutinize your bank statement for unexpected charges from unwanted subscriptions? With the booming subscription-based service industry, it's become easier than ever to lose track of your monthly spending and automatic payments. It's time to regain control of your finances and declutter your budget.

This guide will walk you through how to cancel subscriptions on your Ally Bank credit cards, whether you hold the Ally CashBack Credit Card, Rewards Card, Secured Credit Card, or any other card from Ally, using the bill pay feature and more. Interestingly, Ally Bank doesn't offer a straightforward way to identify recurring subscriptions. Although they provide an article on their website that discusses ways to save money on subscription services and highlight Ally Bank's smart saving tools, a true solution for easy subscription management is still amiss. But fret not, in this blog, we will introduce two manual methods for identifying and cancelling your subscriptions via the mobile app and website.

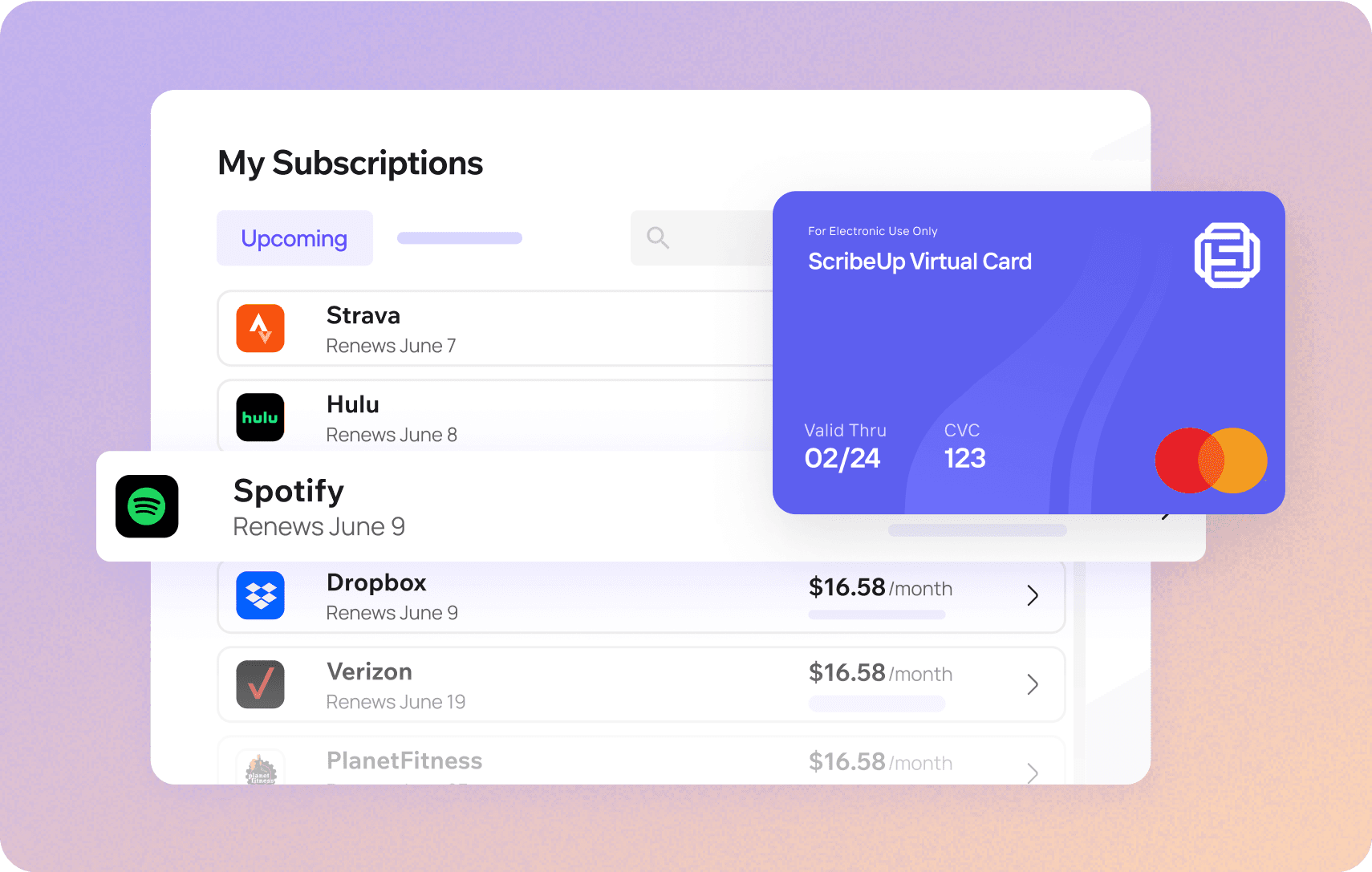

Additionally, we'll also share an automatic method using ScribeUp. These tools and tips will assist you in effectively managing your checking account, helping you avoid late fees and plan bills anytime, ultimately bolstering your savings goals and building an emergency fund.

So, bid adieu to financial stress and take a step towards comprehensive control of your finances with this guide.

Find and cancel all unwanted subscriptions on your Ally Bank Cards

Find and cancel all unwanted subscriptions on your Ally Bank Cards10-steps to cancel subscriptions on your Ally Bank Mobile App

- Login to your Ally Bank Mobile App

- Select the Credit Card (or another Ally Bank Account) that you want to find your recurring payments

- Tap Statements

- Tap on the most recent year and month to find monthly statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Ally card (e.g., Ally Platinum, Ally Everyday Cash Back, Ally Unlimited Cash Back, Ally Unlimited Cash Back for Nurses & Educators) you have in your wallet.

- Review your account regularly

10-steps to cancel subscriptions on ally.com

- Login via https://secure.ally.com/

- Click your name/profile icon (on upper right hand corner)

- In the pull-down menu, click Statements and Tax Forms

- Filter for the month or year that you want to review or click the most recent statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Ally card (e.g., Ally Platinum, Ally Everyday Cash Back, Ally Unlimited Cash Back, Ally Unlimited Cash Back for Nurses & Educators) you have in your wallet.

- Review your account regularly

To effectively manage your finances, it's advisable to review your credit card statements not just annually, but at least twice a year, and at different times. This approach is essential because we tend to add new subscriptions regularly, often lured by their minimal cost. These small, recurring expenses can easily go unnoticed in the broader context of your financial statements. By conducting reviews at separate points in the year, you can better track these additions and ensure that you're not inadvertently accumulating unnecessary subscription costs. This regular scrutiny helps in maintaining a clearer and more controlled financial landscape.

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

With ScribeUp, managing subscriptions on your Ally Bank card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Ally Bank cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Ally Bank Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.